Navigating the Specialist Bridging and Development Finance Market for SME Developers

- Dan Luxon

- Aug 27, 2025

- 2 min read

Introduction

Q2 2025 has brought renewed momentum in the UK’s specialist finance market. For SME developers, understanding the distinct dynamics of bridging finance—both regulated and unregulated—and development finance is essential. This article unpacks rates, structures, and strategic considerations shaping funding decisions today.

1. Bridging Finance – Regulated vs Unregulated

Specialist Market Snapshot (Q2 2025) Source https://www.bridgingtrends.com/

Average monthly rate: 0.81% — down from 0.86% in Q1.

Gross lending: £199.7m; applications: up 11% year-on-year to 460.

Average LTV: ~54%; loan term: ~12 months; first- vs second-charge: 90% / 10%.

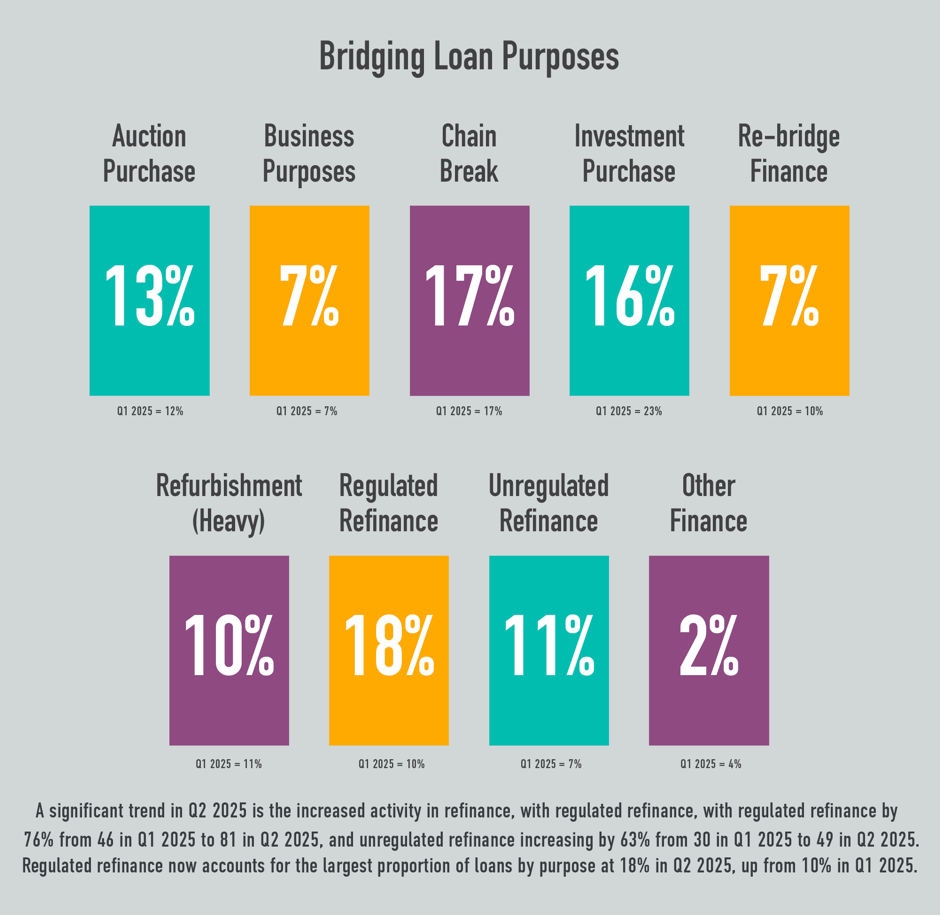

Top borrower intent

Regulated vs Unregulated Defined

Regulated bridging: Secured on a property occupied (or to be) by the borrower or family—FCA-regulated.

Unregulated bridging: Used for commercial or investment purposes; more flexible and faster underwriting.

In Q1 2025, one dataset indicated a split of approximately 44% regulated vs 53% unregulated across specialist bridging—Q2 emphasized purpose rather than overall split.

2. SME-Focused Development Finance

Typical Terms and Structures

Interest (all-in rate): 8%–14% p.a., depending on developer profile and project risk.

Leverage: Common Loan To Cost of 75–90%; LTGDV typically 60–65% (stacked options up to ~75%).

Fees & term: Arrangement fees 1–2%; exit fees vary, generally between 1 & 2% staged drawdowns via IMS; terms 9–48 months.

Public-sector support:

Homes England – Home Building Fund: Up to 5-year loans, commercial variable rates, 80% cost coverage.

ENABLE Build (British Business Bank): £150m facility via Shawbrook launched Jan 2025 to support SME housebuilders.

Policy watch: Potential reclassification of Homes England into a public financing institution ("housing bank") to lower capital costs—expect updates in upcoming spending review.

3. Why It Matters for SME Developers

Product Type | Typical Leverage | Typical Cost | Notes |

Unregulated bridge | LTV ~60–70% | ~0.75–1.00%/month | Quick liquidity, auctions, chain breaks, avg term ~12 mo |

Regulated bridge | Lower LTV | Similar headline rate; tighter terms | For onward consumer purchases |

Development finance | LTC 75–85%, LTGDV 60–65% | ~8–14% p.a. + fees | IMS-drawdowns, 9–24 mo term, exit via sale or refinance |

Speed: Bridging deals are closing faster—Q1 2025 averaged record 32-day completions—yet still cost more than longer-term loans.

Access & cost: SMEs face higher cost of funds than PLCs, but bridging fills short funding gaps, while development finance structures (especially with Homes England backing) ease access.

Conclusion

For SME developers navigating 2025:

Bridging finance is the fastest route for short-term capital—with unregulated options priced from ~0.75%/month.

Development finance offers longer-dated capital at all-in rates between 8–14% p.a., with growing public-sector support.

Evaluate speed vs cost vs leverage; plan exit routes carefully; consult specialist brokers; consider Homes England and ENABLE options to reduce equity strain and cost of capital.

Comments